Enhanced Data

Changes to this page are coming soon to reflect Visa’s CEDP launch. Learn more in the Pagos Blog.

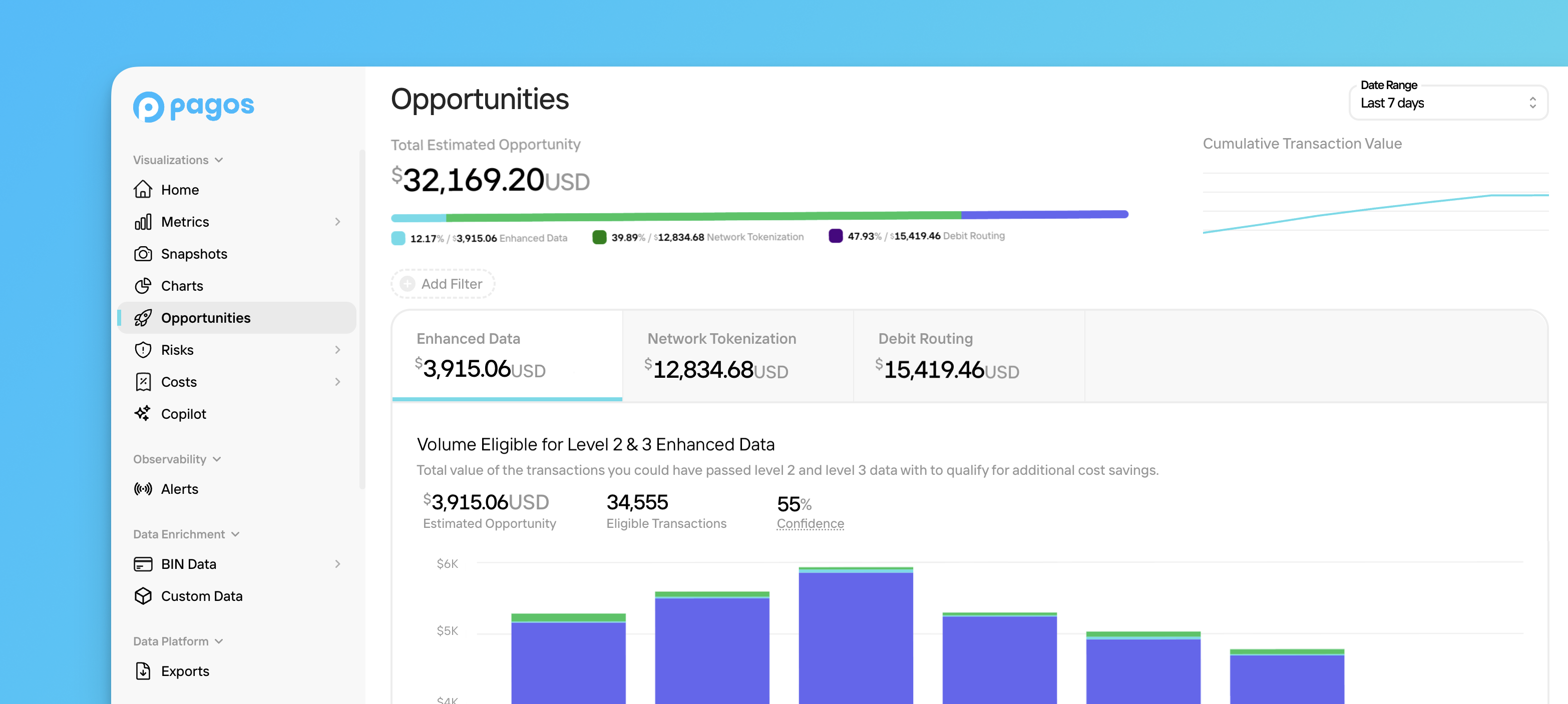

- Estimated Opportunity - The total amount you could have saved, had you passed Level 2 & 3 data with your transactions; the graph below demonstrates these estimated savings over time, broken down by their qualification for only Level 2, Level 2 or 3, and only Level 3 savings.

- Eligible Transactions - The number of transactions you processed that were eligible for Level 2 & 3 data.

- Confidence - Pagos estimates your savings with 55% confidence. This confidence level reflects a key data limitation: we can’t identify how much of your eligible transaction volume actually included enhanced data. Instead, we estimate your savings based on historical data showing the average merchant omits enhanced data on 60–75% of eligible transactions.

Network Tokenization

Network tokenization is the process through which card brands substitute a cardholder’s primary account number (PAN) and other card details with a secure, unique value known as a network token. There are many benefits to network tokenization, including increased data security, increased approval rates, and improved customer experiences. Some transactions also qualify for lower interchange rates when processed with a network token instead of a PAN; the estimated opportunity in this tab represents the transactions for which these savings exist. In the Network Tokenization tab, you’ll find the following data:- Estimated Opportunity - The total amount you could have saved in interchange costs had you processed eligible transactions with network tokens instead of PANs; the graph below demonstrates these estimated savings over time.

- Eligible Transactions - The number of approved, merchant-initiated card transactions you processed with PANs that could have been processed with network tokens instead.

- Confidence - Pagos estimates your savings with 90% confidence using average savings values across historical cost data.

Debit Routing

As of July 2023, issuing banks in the United States must ensure all card-not-present debit transactions can be processed by at least two non-affiliated networks. This change created more competition among debit networks, leading to them offering reduced interchange rates by up to 30% to merchants who route debit transactions through their networks. In the Debit Routing tab, you’ll find the following data:- Estimated Opportunity - The total amount you could have saved had you processed eligible US debit transactions through an alternative debit network; the graph below demonstrates these estimated savings over time, broken down by whether they’re associated with cards issued by Durbin-regulated vs unregulated banks.

- Eligible Transactions - The number of US debit transactions you could have processed through an alternative debit network.

- Confidence - Pagos estimates your savings with 65% confidence. This confidence level reflects the following data limitation: we can’t identify exactly how much of that eligible transaction volume you did route to lower cost networks. Instead, we estimate your savings based on historical data showing the average merchant routes half of their eligible volume to alternative debit networks.